Retirement — it’s the destination on everyone’s horizon. Trying to pin down your future retirement often feels like chasing your own shadow — always there, shifting with every step, and frustratingly difficult to grasp — leaving you wondering if you’re even running in the right direction. Let’s explore the crucial aspects of retirement planning that will guide you on the road to financial security.

Why Saving for Retirement is Worth the Sweat

Many people underestimate the significance of saving for retirement, thinking it’s something they can worry about later. However, the earlier you start saving, the more time your money has to grow. First and foremost, saving can grant you financial independence, ensuring a steady income stream once you exit the workforce. A robust retirement fund also enables you to maintain a comfortable lifestyle, covering essential expenses, travel, and pursuing fulfilling hobbies. Crucially, it serves as a financial safety net for escalating healthcare costs, providing peace of mind and reducing reliance on external sources. Finally, saving for retirement is an investment in your future, offering not only economic security but also the freedom to enjoy the fruits of your labor and maintain financial independence well into your retirement years.

Checking Your Progress: Taking the Mystery Out of the Money Maze

As with any journey, knowing where you stand is crucial. Checking your retirement progress regularly helps you gauge if you’re on track to reach your final destination. Think of it like checking your map during a road trip — you want to make sure you’re heading in the right direction. But how often should you check?

Checking your retirement progress doesn’t mean obsessively monitoring it every day. Instead, aim for a routine checkup — perhaps once a year or whenever there’s a significant life change, like a new job or a pay raise. The key is to find a rhythm that works for you, whether it’s a quick monthly glance or a deep dive every quarter.

Measuring Your Progress: The Retirement Savings Multiple — Your Financial GPS

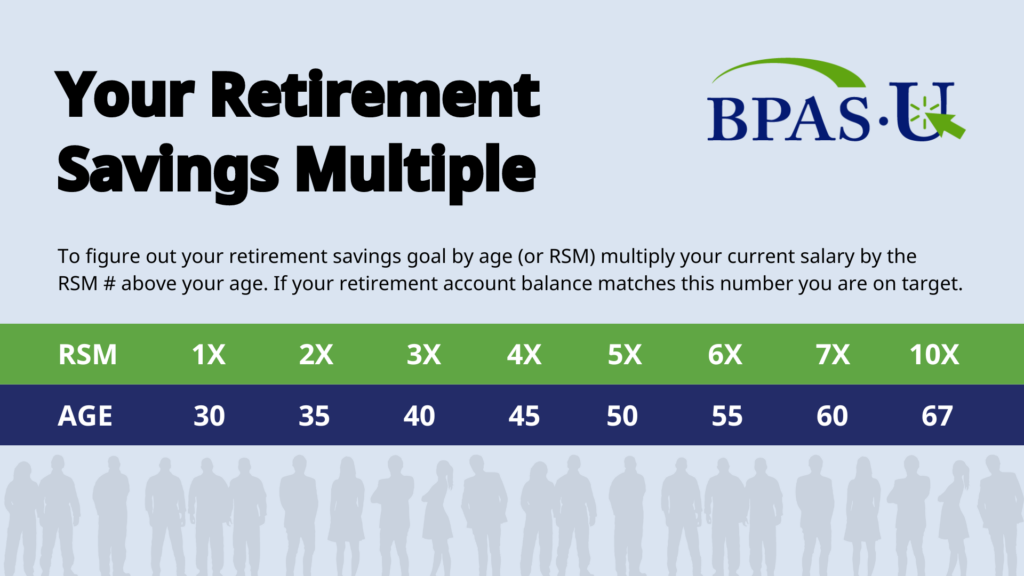

The Retirement Savings Multiple (RSM) acts like a financial GPS, giving you a clear picture of how your savings stack up against your ideal retirement lifestyle. It’s simple: multiply the RSM number that corresponds to your age (see the chart below) by your current annual income to calculate how much you should aim to have saved. Let’s say, for example, you’re 35 years old and your current salary is $30,000. That puts your RSM number at 2. So, 2 x $30,000 = $60,000 you should aim to have saved. The general rule is to aim to have saved 10 times your pay by the time you retire.

Here’s a general guideline to interpret your multiple:

Below 1x: Time to hit the gas! Consider increasing your savings or adjusting your retirement expectations.

1x-3x: You’re on the right track, but keep an eye on the road and maybe make some minor adjustments.

4x-6x: You’re cruising comfortably! Keep up the good work and enjoy the scenery.

7x and above: You’re practically at your destination! Relax and watch your nest egg grow.

Introducing the Roadways Mile Marker: Your Customizable Retirement Roadmap

Forget generic maps — the Roadways Mile Marker is your personalized retirement road trip planner! This awesome tool lets you input your unique financial situation, goals, and desired retirement age and shows you projected outcomes like your possible retirement income, potential surpluses or shortfalls, and how even small adjustments can make a big difference. Think of it as a test drive for your retirement plans. Play around, see what works best, and feel confident knowing you’re heading toward a happy and financially secure destination.

Tracking your retirement progress isn’t about stressing or feeling overwhelmed. Start by understanding why saving for retirement matters to you, build your nest egg little by little, check your progress periodically, and utilize tools like the Mile Marker to customize your plan. Remember, small adjustments today can lead to significant impacts on your financial future. Happy saving!

Quick Tips to Keep Your Retirement Road Trip Smooth

- Don’t wait! Start early or start right now — even small amounts add up over time.

- Take advantage of employer-sponsored retirement plans, like 401(k)s, if available.

- Increase your savings rate whenever possible, even by 1%.

- Review your investments regularly to ensure they align with your goals and risk tolerance.

- Seek professional guidance if you need help creating or adjusting your retirement plan.

- Utilize online resources and tools, like the Mile Marker, to stay on track.

- Celebrate milestones along the way to stay motivated!

Check out our Retirement Planning Page and the Learn Tab for more helpful tips, tricks, and resources to fuel your retirement journey!