A Traditional Individual Retirement Account (IRA) and a Roth IRA are both powerful tools to help you save for retirement. However, there are several key differences to keep in mind when deciding which account, or combination of accounts, makes the most sense for your specific financial situation.

Traditional IRA

Eligibility:

Anyone with earned income can contribute to a Traditional IRA

Contributions:

- Grow tax-deferred

- Are tax deductible, in the year that the contribution is made

Withdrawals:

- Taxed as current income at any age

- A 10% early distribution penalty occurs for withdrawals before age 59.5

- Required minimum distributions (RMD) begin at age 73

Best suited for:

A Traditional IRA is likely best suited for an individual who expects to be in a similar or lower tax bracket when withdrawals begin.

Roth IRA

Eligibility:

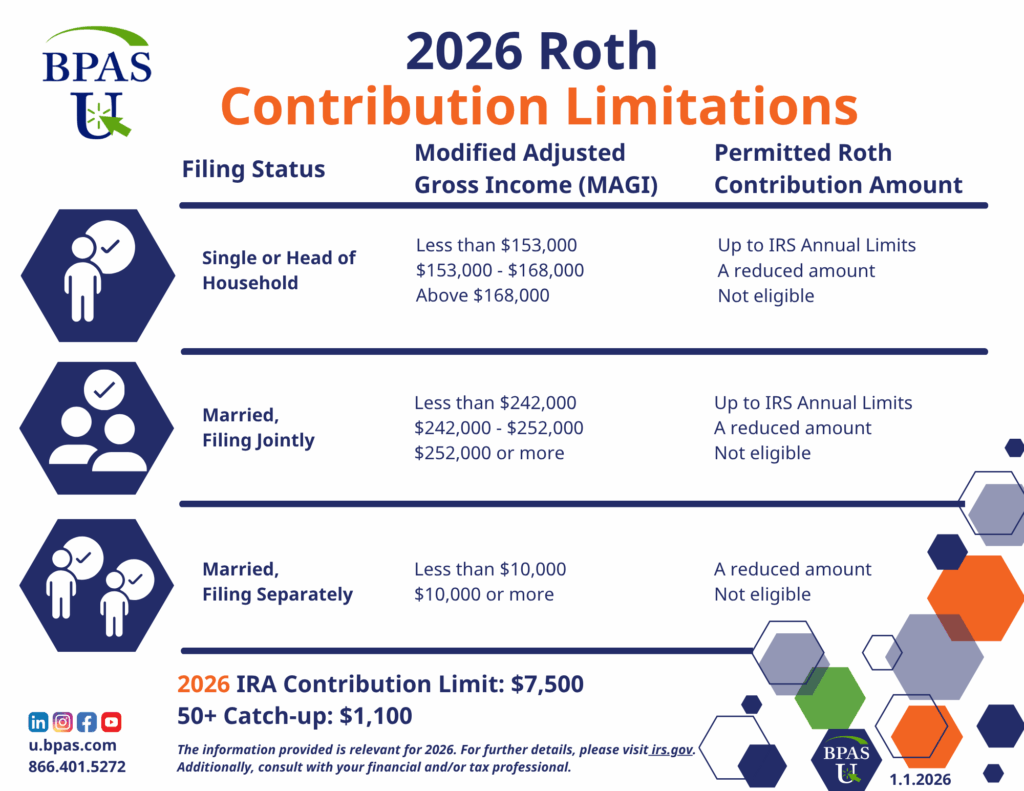

To contribute to a Roth IRA, an individual must have earned income. However, the amount you can contribute may be limited based upon your modified Adjusted Gross Income. Please review the graphic at the bottom of the page to see if this impacts you.

Contributions:

- Grow tax-free

- Are not tax deductible

Withdrawals:

- Qualified withdrawals are tax and penalty free

- Account needs to be open for at least 5 years

- Age 59.5 or older

- No mandatory distributions are required

Best suited for:

A Roth IRA is likely best suited for an individual who expects to be in a higher tax bracket when withdrawals begin.

Comparing the Numbers

Try our Roth IRA vs. Traditional IRA Calculator to see what may work best for you and your situation. As always, it’s important to consult with your financial and tax professionals.